AWS for Industries

Solution for Responding to DCA Complaints for Motor Finance Using AWS Services

The UK motor finance industry faces Complex challenges following the Financial Conduct Authority’s (FCA) review of Discretionary Commission Arrangements (DCA). Financial institutions must now analyze historical lending data, calculate accurate redress amounts, and manage customer communications effectively, all while working with fragmented data sets and tight regulatory deadlines.

In this post, we’ll explore how AWS services help financial organizations build a scalable solution for handling DCA complaints and create a strategic data foundation for future regulatory requirements.

The Challenge

Motor finance providers face several key challenges when addressing DCA complaints:

- Processing large volumes of historical customer data, often stored across disparate systems.

- Extracting relevant information from legacy documents and unstructured data sources.

- Calculating accurate redress amounts based on complex business rules.

- Managing high volumes of customer inquiries across multiple channels.

- Ensuring compliance with GDPR and other regulatory requirements.

- Meeting tight deadlines while maintaining operational efficiency.

Solution Overview

Let’s discuss now a solution approach for DCA complaint handling. The solution architecture comprises four major components.

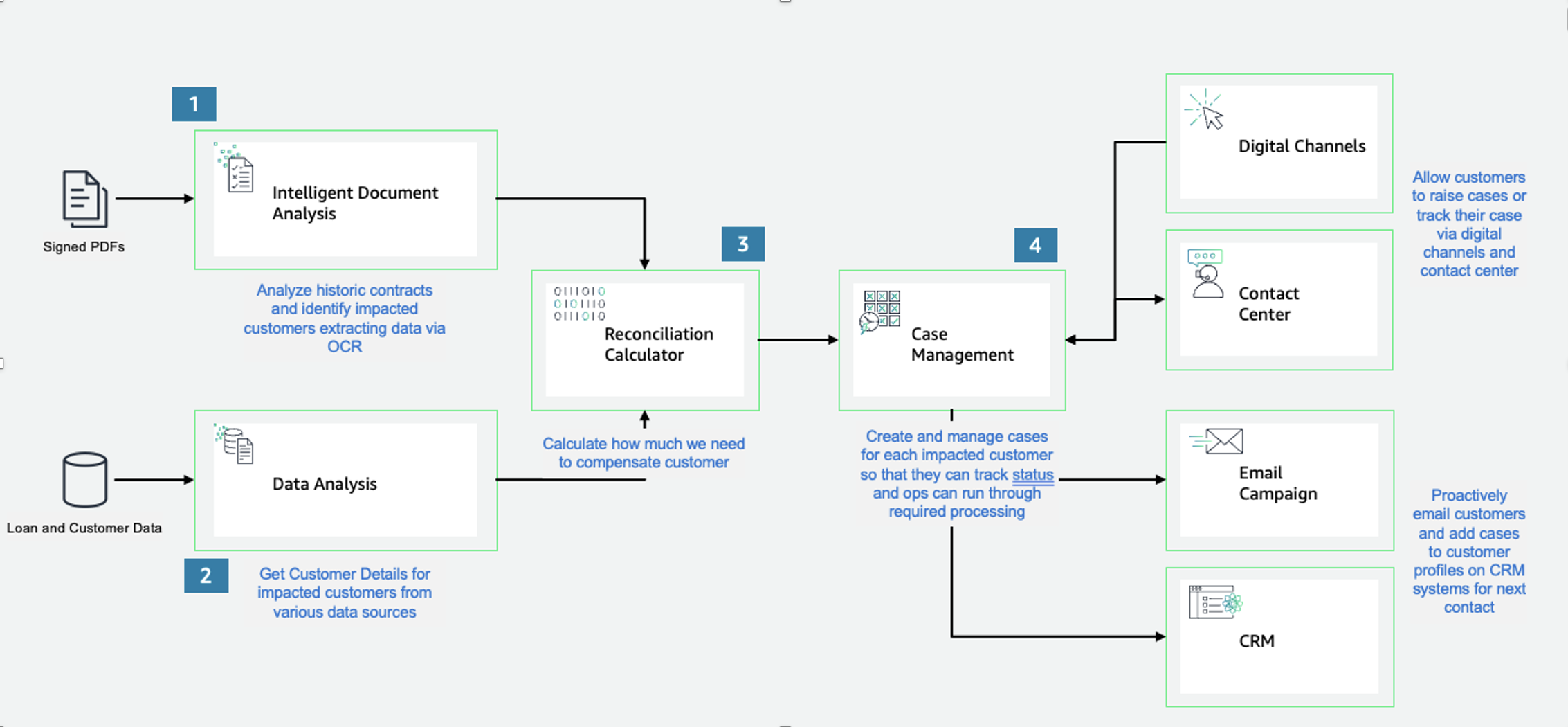

The following diagram illustrates the comprehensive data processing pipeline that transforms raw input files into actionable customer communications. The workflow demonstrates how intelligent document analysis combines with data aggregation to enable targeted outreach across multiple channels.

Figure 1 Components needed for DCA complaint handling

- Intelligent Document Processing: Automatically analyzes finance agreements and broker contracts to identify DCA-affected customers. Extracts key information like original Annual Percentage Rate (APR), final interest rate charged, broker commission levels, and sales documentation. This helps determine affected customers by discretionary commission arrangements and the extent of potential overcharging.

- Data Ingestion and Preparation: The Customer information data is regularly stored in structured and unstructured formats in various data sources or data warehouses; you integrate with these data sources to collect the necessary customer information. Once it identifies an affected customer in step 1, you extract customer details from these data sources to analyze the claim details and customer information required for redress calculations.

- Redress Calculation Engine: Computes customer compensation by comparing the interest rate charged versus what would have been reasonable without broker incentives. Includes historical base rates, risk-based pricing, and actual commission paid to determine fair compensation. This is like how Payment Protection Insurance (PPI) calculates redress, but is specific to motor finance commission structures.

- Customer Communication Management: Handles DCA-related inquiries across multiple channels, whether customers contact through dealerships, directly with finance companies, or through claims management companies. Provides consistent responses about commission arrangements, calculation methods, and compensation process. Manages proactive outreach to affected customers and coordinates responses to Financial Ombudsman Service (FOS) inquiries.

These components work together to help motor finance companies address the volume of DCA complaints while maintaining compliance with FCA requirements and ensuring fair customer outcomes.

We will now show how AWS managed services can help customers quickly build a solution to address DCA complaint handling

AWS Technology Stack for DCA Complaint Handling Solution

Let’s explore how each component of our solution leverages AWS services to create a robust, scalable, and compliant system for handling DCA complaints.

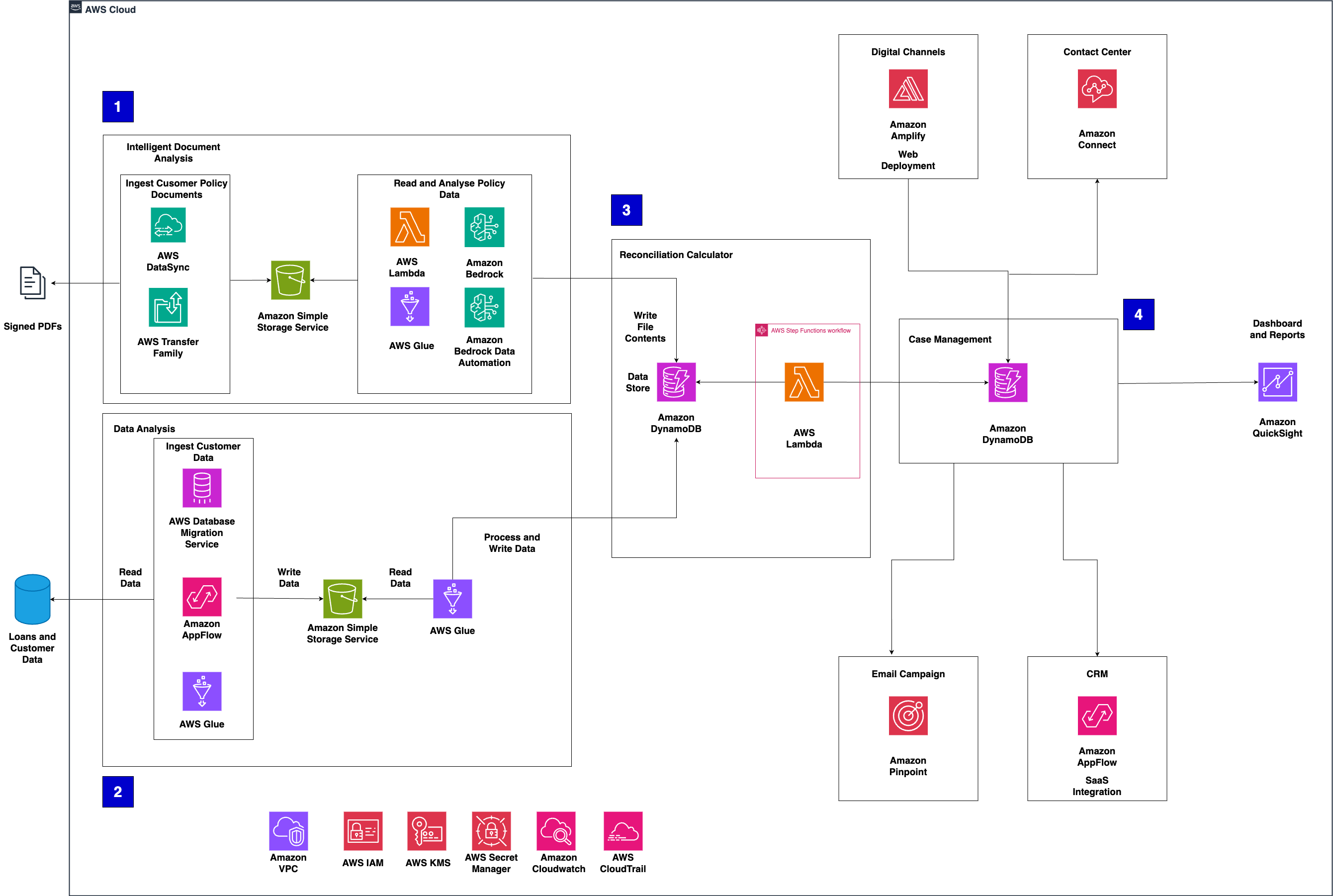

This detailed architecture diagram presents the AWS-based implementation of an intelligent document processing and customer engagement solution. It showcases how various AWS services work together to create a robust data processing pipeline.

Figure 2 Solution Architecture on AWS for DCA Complaint Handling

- Intelligent Document Processing With GenAI

The document processing layer combines powerful generative AI capabilities of Amazon Bedrock Data Automation’s Intelligent Document processing with Amazon Bedrock‘s foundation models to analyze finance agreements and identify DCA-affected customers. This automation process thousands of documents in hours rather than weeks, even if the document formats have changed over the years. The documents can be copied to Amazon Simple Storage Service (S3) buckets using AWS data transfer services like AWS DataSync or AWS Transfer Family. - Data Ingestion and Preparation Layer

AWS Database Migration Service (AWS DMS) securely transfers historical motor finance and customer data from legacy data sources to AWS. Store this data in Amazon S3 data lakes, providing a secure and scalable foundation for customer data transfer to AWS. AWS Glue crawlers automatically catalog customer data to get more information about them, such as contact information, preferred communication channels, loan agreements, commission structures, and interest rate data. Also, Glue jobs standardize and enrich the information. Amazon AppFlow is a fully managed service that securely transfers customer information stored in third party SaaS applications, including Salesforce, SAP, ServiceNow etc. to AWS Services such as Amazon S3. This creates a GDPR-compliant foundation that typically reduces manual data preparation time. - Redress Calculation Engine

At the heart of our solution is a serverless architecture powered by AWS Lambda functions that handle redress calculations at scale. We store business rules in Amazon DynamoDB for consistent application across millions of cases. AWS Step Functions orchestrate the calculation workflow, while Amazon QuickSight provides real-time dashboards for monitoring redress progress and financial impact. This architecture automatically scales during peak complaint periods while maintaining detailed audit logs for FCA compliance. - Customer Communication Hub

We built the customer engagement layer on Amazon Connect, providing an AI-enhanced contact center specifically designed for DCA inquiries. Amazon Pinpoint manages personalized customer communications across channels, while AWS Amplify hosts secure self-service portals where customers track their claims. Amazon AppFlow ensures transparent integration with existing CRM (Customer Relationship Management) systems such as Salesforce, SAP, etc., creating a unified customer experience. Amazon Q in QuickSight empowers risk analysts to query complex datasets using natural language, accelerating the investigation process for any customer queries. - Security and Compliance

The entire solution operates within a secure environment using:

-

- Amazon VPC isolation for network security.

- AWS Key Management Service (AWS KMS) for encryption of sensitive data and AWS Secrets Manager for secrets management.

- AWS Identity and Access Management (AWS IAM) for granular access control.

- Amazon CloudWatch and AWS CloudTrail for continuous monitoring and audit capability.

This comprehensive security framework ensures compliance with both FCA requirements and GDPR regulations, providing the audit trails for regulatory reporting.

By leveraging these AWS services, motor finance companies not only address the immediate DCA complaint challenge but also build a foundation for future regulatory requirements. The serverless architecture ensures cost-effectiveness by scaling with demand, while managed services significantly reduce operational overhead.

This solution facilitates firms to process high volumes of complaints efficiently while maintaining regulatory compliance and delivering excellent customer service – essential elements in addressing the DCA remediation challenge.

Conclusion

The DCA complaint handling challenge requires a robust, scalable solution to process large volumes of historical data while providing excellent customer service. By leveraging AWS services, financial institutions build solutions that not only address current regulatory requirements but also prepare them for future compliance needs.

The immediate solution provides quick time-to-market for DCA complaint handling, while the strategic data platform approach offers long-term benefits for regulatory compliance and customer service. Organizations will need to evaluate their specific needs and resources to determine the most appropriate implementation.

To learn more about how AWS can help your organization address regulatory challenges, contact your AWS account team or an AWS Financial Services competency partners.