AWS Contact Center

Next generation insurance claim processing: Real-time fraud detection with Amazon Connect and Amazon SageMaker AI

Insurance companies face increasing challenges with fraudulent claims, costing the industry billions annually. The Forbes Insurance Fraud Statistics 2025 estimates annual losses of $308.6 billion to insurance fraud in the U.S. Traditional fraud detection in insurance relies heavily on analyzing claims after they’re submitted. This approach leads to claims processing delays, increased operational costs, poor customer experience, and lost income from open reserves.

In this post, we show you how to build a solution that uses both generative AI and traditional machine learning (ML) to detect and report fraud in real time. You’ll learn how to use Amazon Connect to create an AI-powered contact center where customers can report insurance claims through self-service experiences powered by Amazon Q in Connect. We demonstrate how to use prompt engineering to extract key information from customer conversations, and then use that data with ML models in Amazon SageMaker AI to identify potential fraud.

The remainder of this blog post will explore the use case and essential building blocks for creating an AI-native contact center on AWS that increases fraud detection right where it happens.

Solution overview

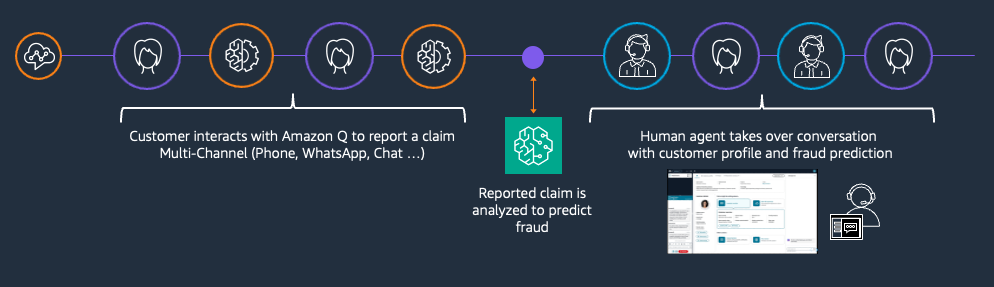

Our solution combines Amazon Q for natural conversations, Amazon SageMaker AI for AI-powered fraud detection, and Amazon Connect for seamless agent handoff. This helps insurance companies detect potential fraud earlier in the claims process while providing a better experience for both customers and agents.The following diagram shows the three main components of the workflow:

Figure 1 – Workflow overview

Let’s walk through how the solution works:

- Multi-channel customer interaction – Customers can initiate a claim through their preferred channel in Amazon Connect – voice, chat, WhatsApp, SMS, or email. Amazon Q in Connect handles these initial interactions naturally and collects the necessary claim details.

- Real-time fraud assessment – As claim information is gathered, the solution triggers an Amazon SageMaker AI endpoint that hosts the fraud detection model. This model analyzes the customer’s profile and claims details to calculate a fraud probability score in real time.

- Intelligent agent handoff – The conversation seamlessly transitions from Amazon Q in Connect to a human agent. Agents see a unified view containing:

- Customer profile information

- Insurance claim details

- Machine learning-powered fraud alert

Architecture overview

Here is an overview of the solution architecture:

Figure 2 – Architecture Overview

- The customer journey begins when they initiate an insurance claim through Amazon Connect, which can handle requests through multiple channels such as voice or chat.

- Amazon Q in Connect takes charge of the conversation, using its integrated Large Language Model (LLM) to engage in natural dialogue with the customer. Following its configured conversation flow, it gathers all required claim information through natural conversation, ensuring each specified data point is collected.

- Once all the required information is collected, Amazon Connect automatically triggers an AWS Lambda function to process the claim data. This function serves as the bridge between the customer interaction and the fraud detection system.

- The Lambda function then communicates with an Amazon SageMaker AI endpoint that hosts the custom fraud detection model. This model, which was developed and trained in a SageMaker AI Jupyter Notebook environment, analyzes the claim details and returns a ‘POTENTIAL FRAUD’ alert when the claim matches patterns that require additional investigation.

- The fraud detection results are promptly sent back to Amazon Connect, where they’re integrated with the existing claim information.

- Finally, the call transitions smoothly to a human agent, who receives a comprehensive dashboard view containing both the claim details and the fraud prediction results. This consolidated view empowers the agent to make well-informed decisions about how to proceed with the claim.

Intelligent claim intake with Amazon Q in Connect

Amazon Q in Connect offers powerful customization options through three key components: AI prompts, guardrails, and agents. Let’s break down each element and understand how they work together to create an effective AI-powered intelligent first notice of loss.

- AI prompts: AI prompts are instructions that tell the large language model (LLM) what to do. Think of them as detailed job descriptions for the AI. Amazon Q in Connect makes this accessible to non-developers by providing user-friendly templates in YAML format.

- AI guardrails: The Guardrails serve as protective mechanisms that ensure responsible AI usage.

- AI agents: The AI agents are the overarching resources that bring everything together. They manage which prompts and guardrails are used for different scenarios, including:

These components allow businesses to create customized, safe, and effective AI-powered customer service experiences while maintaining control over the AI’s behavior and outputs. In the following, we will focus on the AI Prompt component and explain how to create a self-service prompt that can be used to handle claim intake. Amazon Q supports two primary formats: MESSAGES and TEXT_COMPLETIONS, with the former being ideal for our specific self-service use case.

The MESSAGES format contains the following components:

- System instructions: Define the AI’s role and behavior

- Messages: Contain the conversation flow

- Tools: Specify available actions for the AI

Each of these components uses different prompt engineering techniques to achieve the required result.

System instructions

The bot’s behavior is shaped by carefully crafted system instructions using meta-prompting techniques. Here’s an example:

This prompt effectively sets the AI’s role, behavior constraints, and specific tasks it should carry out.

Tool instructions

Amazon SageMaker AI is a fully managed machine learning service that enables developers and data scientists to build, train, and deploy ML models at scale. For our insurance claims solution, SageMaker AI provides the ideal platform by offering the computational power needed for complex fraud detection models, while maintaining the flexibility to customize and refine these models over time. Its seamless integration with other AWS services and ability to serve real-time predictions makes it particularly well-suited for time-sensitive fraud detection workflows where quick, accurate decisions are crucial.

Following the methodology outlined in the Detect fraudulent transactions using machine learning with Amazon SageMaker AWS blog post, we trained a SageMaker AI XGBoost model using a sample vehicle insurance fraud dataset. To address the heavy data imbalance towards the negative class that is often seen in fraud detection cases, we used the Synthetic Minority Over-sampling Technique (SMOTE), oversampling the positive class by creating new synthetic samples of it.

The trained model was deployed to a SageMaker AI real-time inference endpoint, which seamlessly integrates with Amazon Connect through an AWS Lambda function. This function processes the data collected during the call flow and triggers the model inference—creating a fluid, automated detection system. The endpoint delivers real-time fraud predictions, enabling Amazon Connect agents to instantly identify high-risk claims.

While this solution demonstrates the potential of machine learning in fraud detection, it’s important to note that this example uses a simplified approach with sample data. For production implementations, we strongly recommend organizations use their own historical data to train models that reflect their specific fraud patterns and risk profiles. Additionally, consider exploring the AWS Marketplace for specialized fraud detection solutions from our partners, or engaging with AWS Professional Services and AWS Partner Network (APN) Partners who offer expertise in building sophisticated fraud detection systems. Organizations should also ensure their implementation adheres to relevant compliance requirements and industry regulations for fraud detection and data handling.

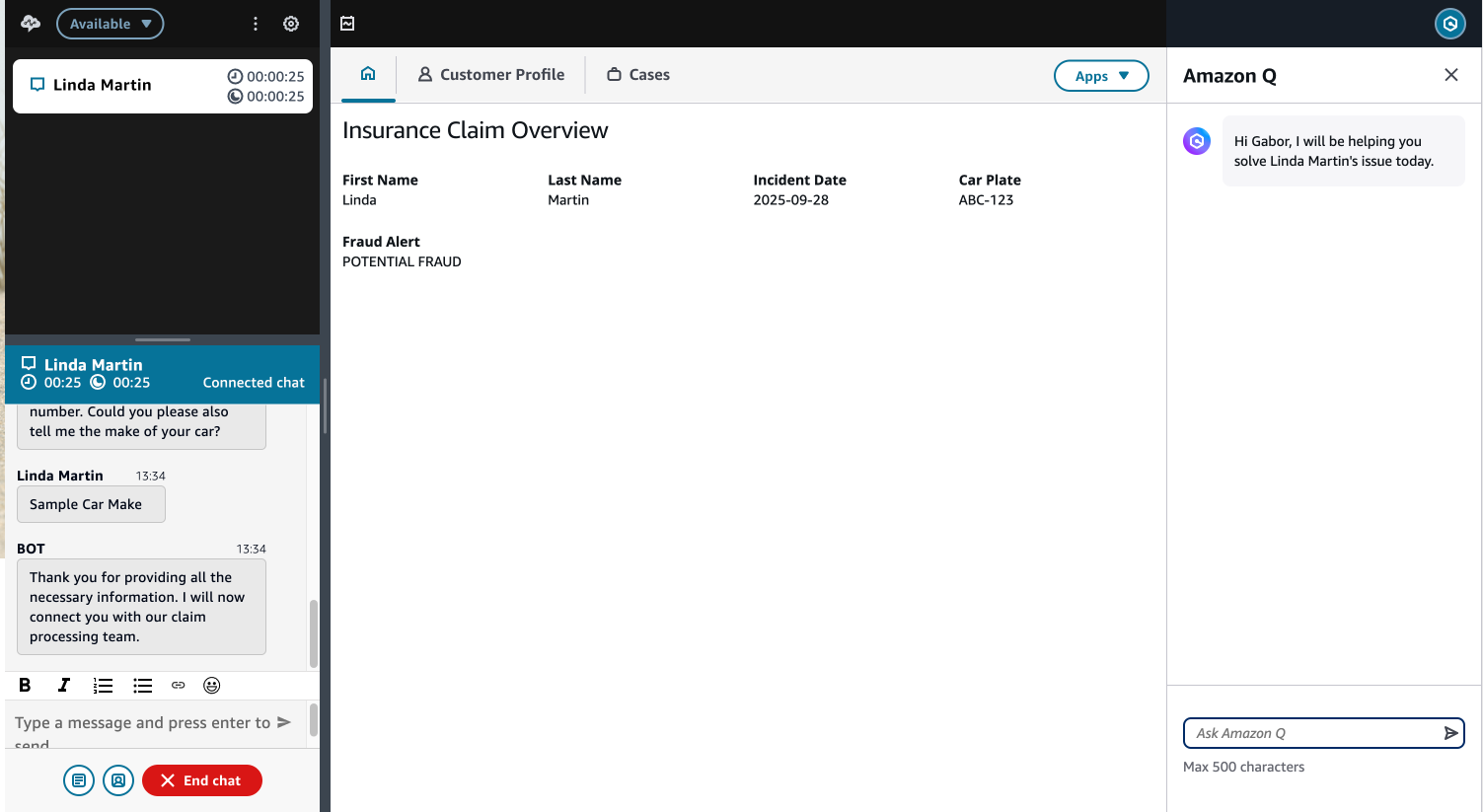

Enhanced agent workspace with fraud intelligence

When agents handle customer conversations, they need quick access to relevant information to make informed decisions. Our solution enhances the agent workspace by seamlessly integrating real-time fraud intelligence into their workflow. Using Amazon Connect views, organizations can tailor how this information is presented to agents. As shown on the screenshot below, we’ve designed an intuitive, comprehensive interface that displays the AI-generated fraud risk assessment alongside standard call information. Views can be fully customized to match specific organizational needs, enabling teams to create the most effective layout for their agents.

Figure 3 – Agent Workspace Overview

The enhanced workspace presents fraud alerts in a clear, actionable format that doesn’t disrupt the natural flow of customer interaction. When the machine learning model flags a potential fraud risk, agents receive a prominent but non-intrusive notification. This allows them to maintain professional customer service while taking appropriate precautions.

Amazon Connect’s robust flow designer enables organizations to create custom handling paths based on the fraud detection results. The service’s visual workflow builder makes it simple to implement various response scenarios, such as:

- Automatically routing high-risk calls to specialized fraud investigation teams

- Triggering additional verification workflows with dynamic questioning

- Creating real-time notifications for supervisor intervention

- Adding cases to specific queues for post-call review

These capabilities allow organizations to seamlessly incorporate fraud detection responses into their existing contact center operations. Contact flows can be quickly adjusted to modify alert thresholds or update response procedures, ensuring organizations can adapt their workflows as fraud patterns and business needs evolve, while maintaining compliance with established protocols.

Call to action

Transform your insurance claim processing with AI-powered fraud detection. This solution demonstrates how Amazon Connect and SageMaker AI can work together to provide real-time intelligence for risk assessments on insurance claims.

Learn Amazon Connect core concepts and earn a badge as communications specialist and developer with Amazon Connect Learning Plans and Badges.

Get hands-on with Amazon Q in Connect Workshop that are designed to teach or introduce practical skills, techniques, or concepts which you can use to solve business problems.

About the Authors

Gabor Toth is a Solutions Architect at AWS supporting Small and Medium Business customers in Germany to innovate and grow through AWS technology. With a focus on AI/ML solutions, Gabor helps customers unlock the full potential of artificial intelligence in their business. Beyond cloud, he’s passionate about football and enjoys quality time with friends and family.

Gabor Toth is a Solutions Architect at AWS supporting Small and Medium Business customers in Germany to innovate and grow through AWS technology. With a focus on AI/ML solutions, Gabor helps customers unlock the full potential of artificial intelligence in their business. Beyond cloud, he’s passionate about football and enjoys quality time with friends and family.

d

d

Andreas Rotaru is a Solutions Architect at AWS, supporting SMB customers in Germany. Based on his background in Conversational AI, Financial Services, Cloud Computing and Serverless architectures, he helps organizations innovate and transform their applications in the cloud. Andreas is passionate about connecting emerging technologies with real-world business challenges to create practical, future-ready solutions.

Andreas Rotaru is a Solutions Architect at AWS, supporting SMB customers in Germany. Based on his background in Conversational AI, Financial Services, Cloud Computing and Serverless architectures, he helps organizations innovate and transform their applications in the cloud. Andreas is passionate about connecting emerging technologies with real-world business challenges to create practical, future-ready solutions.