AWS Partner Network (APN) Blog

Lowering customer acquisition cost with Moneythor on AWS

By Thibault Weintraub, CTO – Moneythor

By Lorna Waldron, VP Marketing – Moneythor

By Marouane Sefiani, Sr Partner Solutions Architect – AWS

By YokeTong Tan, Partner Solutions Architect – AWS

|

| Moneythor |

|

New and existing banks create intense competition in the financial sector. To succeed in this saturated market, financial institutions must reduce their customer acquisition cost (CAC) and offer distinctive services.

CAC directly impacts profitability as a key performance indicator. Financial institutions can lower acquisition costs by using growth strategies such as referral programs. This provides real-time, digital reward redemption through referrals from friends and family. Beyond acquisition, the institutions must retain and grow customers by fostering long-term engagement.

Moneythor, an Amazon Web Services (AWS) partner, offers an engagement solution, enabling banks to add real-time personalization to their digital banking services, bringing contextualized and actionable insights & nudges embedded in the main customer journeys.

In this post, you will learn how Moneythor’s solution lowers customer acquisition cost and increases customer engagement through personalization and gamification in financial services.

Solution overview

Moneythor’s solution on AWS delivers personalized banking experiences through dynamic money management tools, tailored loyalty programs, gamified experiences and real time notifications and alerts. Tailored loyalty programs include incentivized referral programs, merchant coupons, and stamp cards. The solution processes financial transactions from core banking systems and delivers enriched data insights and personalized nudges to end-users through various digital channels. Moneythor Studio, the management interface, provides banks with the capability to customize logic and create personalized customer journeys without requiring development resources.

Figure 1 Moneythor’s Data Flow Overview

Depicted in Figure 1, Moneythor’ solution is composed of a data integration layer and a processing engine. The data integration layer connects to the bank core systems and ingests transaction data. The processing engine uses analytics and ML models along with the ingested data for personalization.

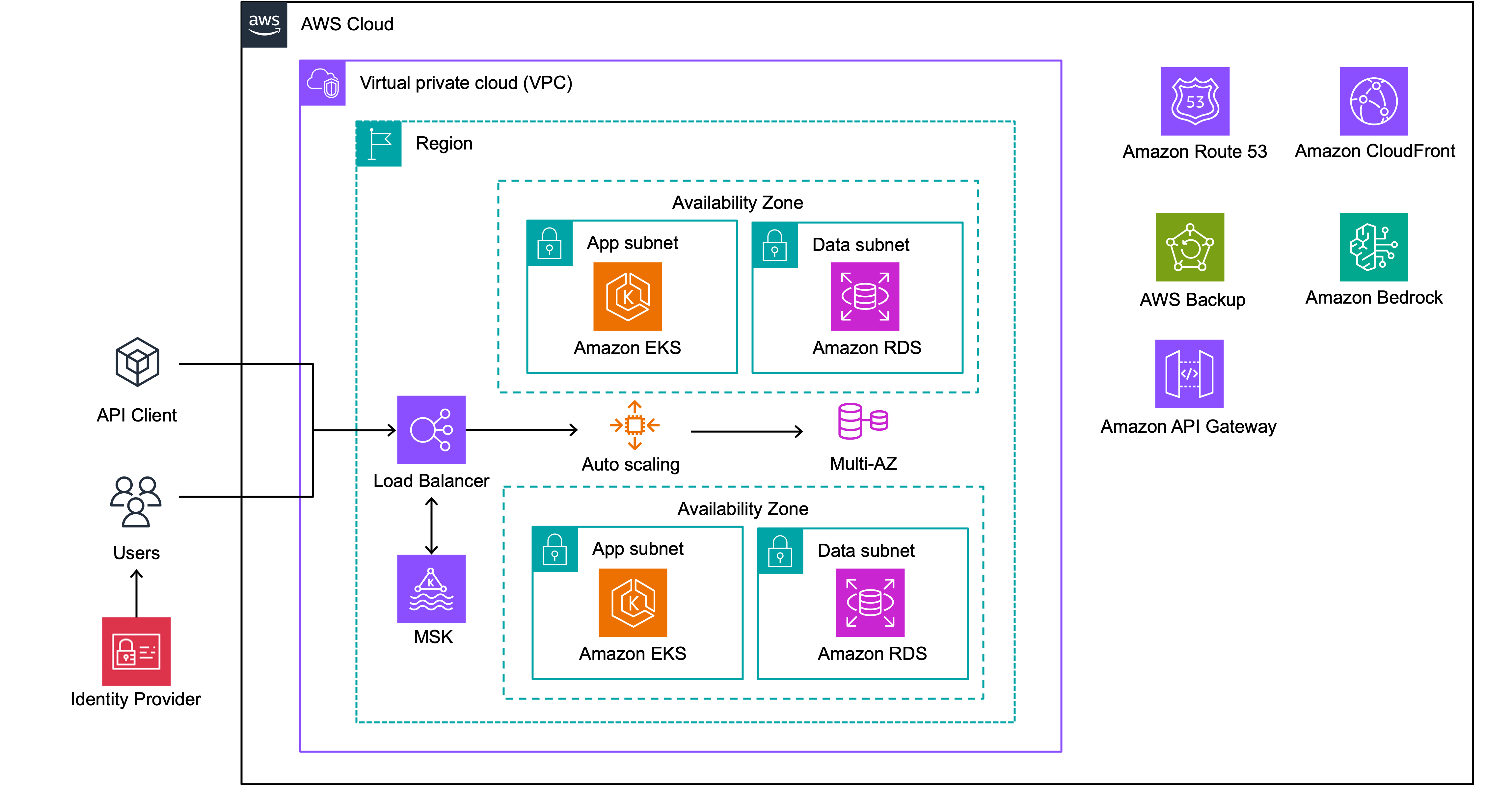

Figure 2 Moneythor’s AWS Architecture

Figure 2 illustrates the architecture diagram of Moneythor’s solution on AWS. The data integration layer uses Amazon Managed Streaming for Apache Kafka (Amazon MSK) to ingest data from core banking systems.

The processing engine uses Amazon Elastic Kubernetes Service (Amazon EKS) for container orchestration and microservices deployment, Amazon Relational Database Service (Amazon RDS) for database management with enhanced security features, and Amazon Bedrock is used for generative capabilities. Amazon EKS with auto scaling and Amazon RDS are deployed across multiple availability zones for scalability and availability.

The solution utilizes AWS Backup for centralized backup management, Amazon API Gateway for API management and security and Amazon CloudFront for content delivery and edge computing.

Trust Bank achieves 70% customer referral–driven growth with Moneythor

Trust Bank, a joint venture between Standard Chartered and FairPrice Group, was launched in 2022 and used a customized Moneythor’s core solution on AWS, without Amazon Bedrock implementation, to achieve the following acquisition and engagement results.

As of end 2024, 70 percent of Trust’s new sign-ups came from existing customer referrals. On top of that, its customer acquisition cost is about 1/7th the industry norm.

Customers are also highly engaged, with 3.2 million digital coupons redeemed by 2024. Trust Bank’s innovative “Budget Buddies” feature visualizes personalized spending insights through dynamic animated characters that grow with spending activity, turning routine financial tracking into a fun, engaging experience. Trust is one of the top-rated banks in Singapore on the Apple App Store and has received extensive industry awards, including the best digital bank in Singapore by The Asian Banker and best mobile banking app globally by The Digital Banker.

Conclusion

As an AWS Partner, Moneythor provides personalization capabilities for financial institutions, enabling digital banking innovation through its solution. The platform integrates with existing core banking systems to deliver scalable, real-time customer engagement features.

Moneythor’s solution on AWS provides an automated approach to personalization and rewards management, enabling banks to lower customer acquisition costs and increase engagement

Contact Moneythor to schedule a demo and discover how the solution can transform your digital banking experience.

About Moneythor

Moneythor provides financial institutions with advanced data-driven personalization and customer engagement solutions. By using transaction data and behavioral science, Moneythor’s platform delivers real-time, personalized recommendations, insights, and rewards that enhance customer experiences and drive engagement.

.

Moneythor – AWS Partner Spotlight

Moneythor is an AWS Technology Partner that provides a comprehensive system of engagement enabling banks and fintech firms to add real-time personalization to their digital banking services, bringing contextualized and actionable insights & nudges embedded in the main customer journeys.

Contact Moneythor | Partner Overview | AWS Marketplace